Medicare Choices Simplified”

Dayspring Benefits, LLC, formerly Medicare Basic, is an independent health insurance agency dedicated to helping those eligible to find Medicare Supplement Insurance to meet their needs. Making medicare insurance decisions can sometimes be a little overwhelming. We’re here to answer your questions and help simplify that process!

What is Medicare?

Medicare is the federal health insurance program administered by the Centers for Medicare and Medicaid Services (CMS) for:

- People who are 65 or older and have paid Medicare taxes, which should have been deducted from your paycheck, for at least 10 years during their lifetime

- Certain younger people with disabilities

- People with End-Stage Renal Disease (ESRD)

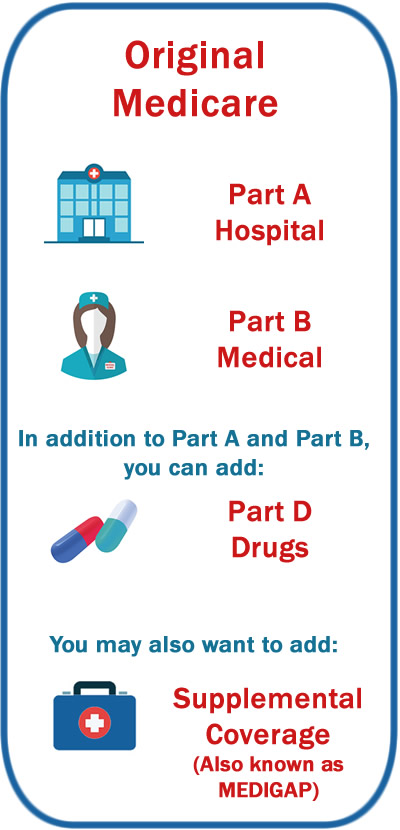

Parts of Medicare:

- MEDICARE PART A (Hospital Insurance)

Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, as well as some home health care. Part A is administered and managed by the government.

- MEDICARE PART B (Medical Insurance)

Part B – certain doctors’ services, outpatient care, medical supplies, and preventive services. Part B is administered and managed by the government.

- MEDICARE PART C (Advantage Plans)

Part C -Medicare Advantage is an “all in one” alternative to Original Medicare. These bundled plans include Part A, Part B, and usually Part D. Advantage plans are run by private insurance companies, although they are regulated by the government.

- MEDICARE PART D (Drug Coverage)

Part D -Helps cover the cost of prescription drugs.

Medicare drug coverage plans are run by private insurance companies, although they are regulated by Medicare.

The 2 Main Ways To Get Medicare are:

ORIGINAL MEDICARE

and

MEDICARE ADVANTAGE

Original Medicare to Medicare Advantage (Part C) Partial Comparison:

Medicare

Advantage

Medicare Supplements (Medigap)

Medicare Supplement Insurance, also known as “Medigap,” helps to fill in the “gaps” in Original Medicare and is sold by private insurance companies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, as shown in the chart below, where we will take a look at plans G and N (the two most popular plans available to newly eligible Medicare beneficiaries). To see all of the Medigap plans, click here: Medicare Supplement Plans

Click the phone number above to call us and find out how you can pick up a Medicare Supplement plan, change plans or even shop better rates for the same exact plan that you are on now!